WEBSTER BANKChannel shift to self-assist

I led the discovery and analysis of digging into several self-service journeys from initial stakeholder interviews, customer journey mapping, service blueprinting, and presenting the findings and recommendations to senior leadership. My recommendations have been implemented on our Online Banking platform and led to a significant decrease in calls to the Customer Contact Center (C3).

ROLELead service designer

DURATIONNovember 2021 - January 2022TEAMVarious product owners, IT partners

PROBLEM

As part of an organization-wide effort to minimize operational costs, the Customer Contact Center (C3) was highlighted as an area that had a lot of opportunity for operational improvements and cost savings. As part of this initiative, Senior Leadership identified five self-service digital journeys that needed to be revisited to help the bank accelerate the move from staff-assist to self-assist:

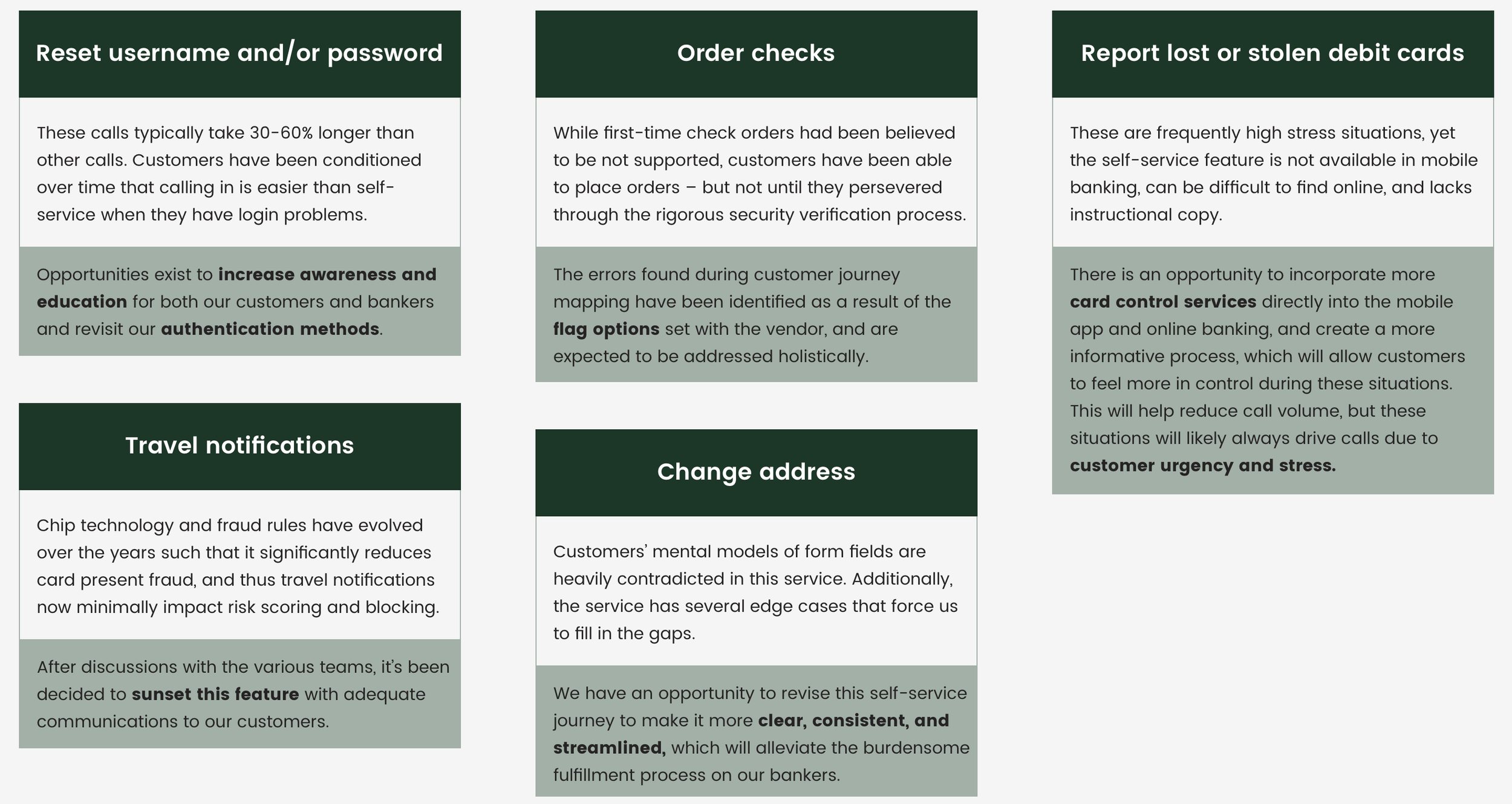

Reset username and/or password (UNPW)

Order checks

Report lost or stolen debit cards

Travel notifications

Change address

MY STRATEGY

RESEARCH

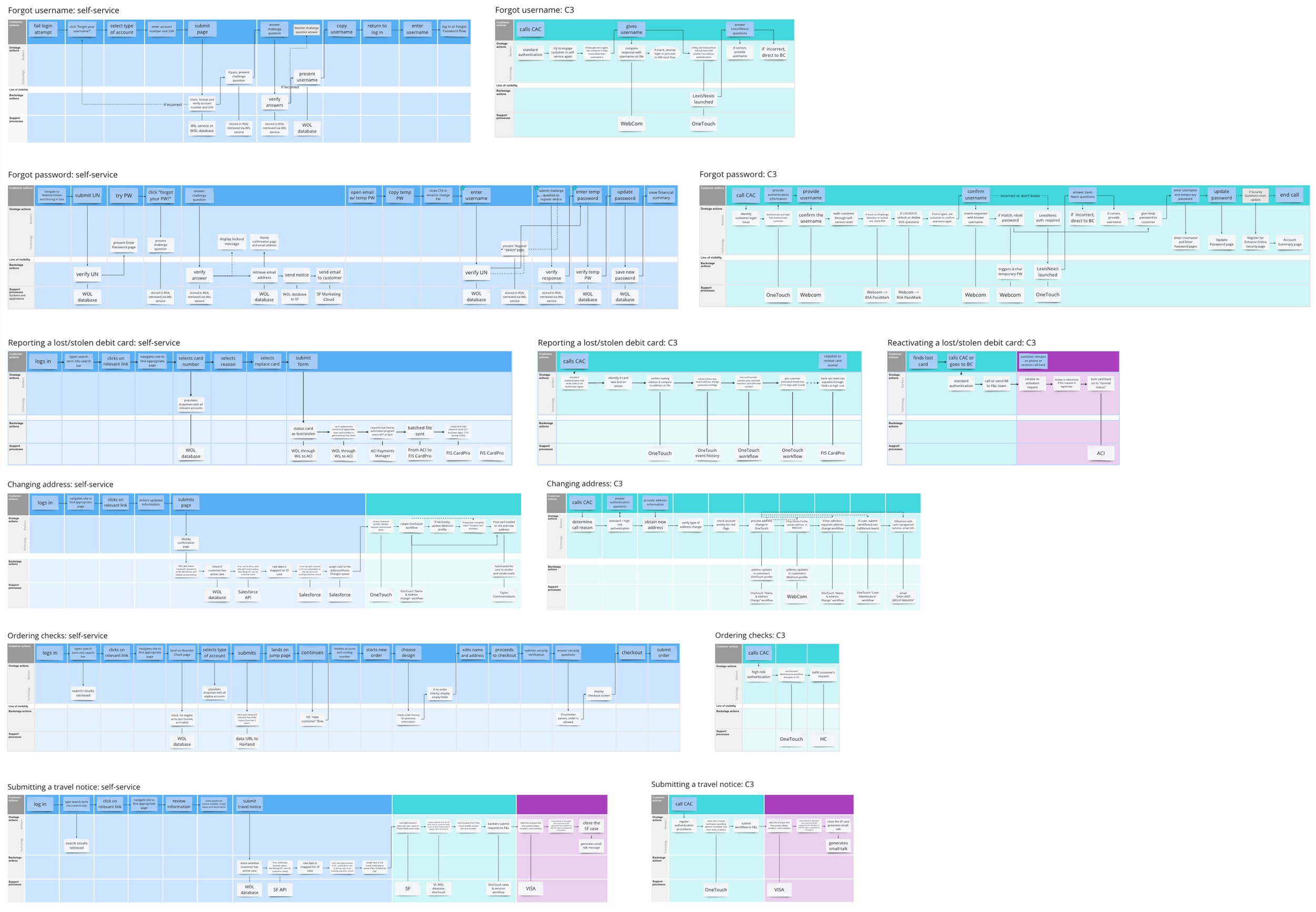

Before starting this project, I needed to understand why these specific journeys were selected and why they were driving so much call volume to the C3. The best way to do so was to experience these self-services on my own as well as talk to the folks to have direct touchpoints to the experience or the customers going through it. I went through the experiences on my own account and documented my findings. I tested my findings against some stakeholders, who were able to confirm and add some of their own observations. I also pulled additional insight from our customer feedback system. With this information, I created about a dozen customer journey maps, also documenting any edge cases and additional user flows.

DIGGING DEEPER

After completing the journey maps, it was clear that the customer-facing screens and actions had pain points, but didn’t explain the inefficiencies and drive to the C3. To understand the underlying issues, I needed to understand what happened post-customer interactions. I met with several teams across the organization that handle the backend processing of these services. The majority of our knowledge came from the Online Banking team, who fortunately had some sequence diagrams to help fill in the knowledge gaps. When possible, I made sure to take note of the time it took for these steps to occur. I also made sure to document not only the customers’ actions, but also our bankers’ and servicing team’s when handling these calls and issues.

RESEARCH TAKEAWAYS

-

• Challenge questions are an outdated and inefficient approach, yet they are the only way to retrieve your credentials.

• Troubleshooting login issues is complicated and high-risk.

• The level of tech literacy of customers and bankers exacerbates complexity to the troubleshooting process.

• Multiple points of failure lead to more channel deflection.

-

• We send over limited customer data, so the vendor has to rely on order history to populate this information.

• The vendor does not send any data back to us, which leaves a huge gap of opportunity for personalization.

• Our settings currently do not accept first-time check orders unless the customer passes cumbersome security verification steps.

• Any changes made will be at a bank level and affect all personal, business, and commercial accounts.

-

• These circumstances often have a very high sense of urgency, yet there is no immediate self-service.

• Site search functionality is basic and keywords must match our page titles exactly (e.g. “lost” finds relevant page but “lost debit” shows no results.)

• Even if a customer finds their card soon after reporting it, they might still have to wait for 7-14 days and use the new replacement card.

• There is no ability to dispute charges online in the event of stolen card with fraudulent charges.

-

• It takes 3-5 days to process the requests, which doesn’t meet customers’ expectations of the service.

• This feature exists mostly for the customer’s peace of mind than for fraud practices.

• Hand-off between teams is inefficient and unnecessary (e.g. any requests that come in during the weekend won’t be addressed until Monday.)

-

• This service exists on the account level, not a product level.

• The form field UI is confusing and the behavior is unexpected.

• The current confirmation method is to send post cards to the new and old address, which gives an open window of 5-10 days of potential fraud.

• There is no address field validation within the form, so it is entirely dependent on bankers to recognize if there is a typo or mismatch of information.

OUTCOMES

TAKEAWAYS

This project cemented the value proposition of the design process; specifically, the benefits of bringing this type of thinking earlier in project phases. While my work was insightful, I wondered if there were more impactful journeys that we could have focused on that affected our customers on a greater magnitude.